Since its inception, Bitcoin has been hailed by some as a revolutionary technology with the potential to transform the way we conduct transactions using a new financial layer. Recently, a new innovation has emerged that could unlock new possibilities for the Bitcoin network to also function as a cultural layer. Ordinals1, which refer to NFT2-like assets on the Bitcoin network, had their start in December 2022 when Bitcoin developer Casey Rodarmor released the ORD software. Each bitcoin can be subdivided into 100 million smaller units called “satoshis,” and while normally these satoshis are fungible3, ORD assigns numerical values to individual satoshis, allowing for uniqueness. More specifically, ORD, which runs on top of a Bitcoin Core full node, allows users to add arbitrary data to a Bitcoin transaction (“inscription”) and tie the data to an individual satoshi4 (“ordinal”). Ordinals have generated a great deal of attention in the crypto ecosystem, surpassing one million inscriptions on April 8, 2023 (Figure 2), and sparking a conversation about the potential to unlock new possibilities for the Bitcoin network.

Figure 1: Simplified Bitcoin Inscriptions and Ordinals Example

Source: Grayscale Research

灰度:Ordinals代表了比特币采用的更大机会之一:金色财经报道,灰度在其官网上发文谈BTC Ordinals,文章称,Ordinals有效地在比特币网络上创建了一个NFT,虽然有些人批评Ordinals,警告不要让区块链膨胀或损害可替代性,但我们认为Ordinals代表了比特币采用的更大机会之一,尤其是在比特币网络历来被视为刚性区块链生态系统的情况下。我们认为Ordinals在两个关键方面对比特币网络有积极影响:1.导致比特币矿工费用增加,2.可能促进比特币社区内的文化转型。??

此外,与 ERC721不同,Ordinals由于其不可变的性质、缺乏可编程性和强制性的链上铭文要求,呈现了不可替代数字资产的直接表现。尽管以太坊NFT拥有更强的可编程性,并且目前在数量和受欢迎程度方面主导着NFT市场,但对于那些在最成熟的可用区块链上寻求直接、稀缺数字资产的人来说,Ordinal可能是一个有吸引力的选择。[2023/4/30 14:35:41]

This process effectively creates a Non-Fungible Token (“NFT”) on the Bitcoin network. While some are critical of ordinals, cautioning against bloating the blockchain or harming fungibility, we believe that ordinals represent one of the larger opportunities for Bitcoin adoption, especially as the Bitcoin network has historically been viewed as a rigid blockchain ecosystem.

Figure 2: Ordinals Count

Source: Dune, @dgtl_assets, as of 4/21/2023

Despite their recent popularity, ordinals are not the first instance of NFTs on the Bitcoin blockchain. Renowned Bitcoin NFT projects, such as Rare Pepe Cards (Figure 3), employed a Layer 25 network known as Counterparty, which was established in 2014. However, Counterparty’s Layer 2 infrastructure was criticized for being complicated, which left room for other approaches to take hold. While the Counterparty network may seem less relevant today, it still represents one of the first instances in crypto’s history where users created and traded unique digital assets – and arguably could have spurred the mass excitement around NFTs, more broadly.

灰度:Robinhood 新增支持灰度比特币信托和灰度以太坊信托:5月6日消息,灰度(Grayscale)宣布股票和加密货币交易平台 Robinhood 新增支持灰度比特币信托(GBTC)和灰度以太坊信托(ETHE)的交易。[2022/5/6 2:55:41]

Figure 3: Rare Pepe Card on Counterparty Network

Source: Rare Pepes

Ordinals stand out among Bitcoin NFT endeavors due to their independence from Layer 2 solutions. Rather than relying on such solutions, ordinals capitalize on previous Bitcoin network enhancements, such as SegWit (conducted in 2017, and increased Bitcoin block size limit to 4MB) and Taproot (conducted in 2021, and added more complex scripting in the witness6 section of the transaction). Ultimately, ordinals enable data to be directly embedded within the witness segment of a Bitcoin transaction. Ordinals can be composed of almost any type of data, ranging from pictures to videos to applications (Figure 4).

Figure 4: Example of a Bitcoin Ordinal

Source: Doom Clone NFT

As the use of ordinals deviates from the conventional peer-to-peer electronic cash system, numerous criticisms have arisen from those who disapprove of them. Generally, these criticisms can be summarized as follows:

Straying from Bitcoin’s initially conceived purpose: Utilizing the Bitcoin network to store arbitrary data contradicts the primary objective outlined in Satoshi’s 2013 whitepaper, which is for Bitcoin to serve as a “peer-to-peer electronic cash system.“

灰度:拥有比特币的美国人已经从2020年的23%增加到2021年的26%:金色财经报道,1月30日灰度发布《2021年比特币投资者研究》报告,报告称,在通货膨胀的经济时期,人们对比特币作为一种价值储存资产的认识有所提高。投资者已经越来越倾向于将比特币作为一种可盈利的长期投资,而不是作为一种货币。此外,比特币正越来越多地跨越时代,接触到老年投资者,包括热衷于考虑将比特币投资产品作为一个组成部分的退休人员,比特币投资产品作为他们投资组合的一个组成部分,提供直接接触比特币价格的ETF被许多人视为关键因素。

此外,比特币主流的采用已经到来,拥有比特币的美国人已经从2020年的23%增加到2021年的26%,2020这个群体中超过一半(59%)的人选择通过以下方式进行投资,加密货币交易应用程序,如eToro或Coinbase,这意味着去年,超过四分之三的投资者(77%)倾向于使用比特币交易软件,这是一个范式的转变。[2022/1/30 9:22:50]

Blockchain bloat: Embedding additional data into the blockchain increases its size, making it more challenging to download and some argue that ordinals clutter the blockchain with extraneous information.

Compromises fungibility: If a substantial number of satoshis are inscribed, Bitcoin’s fungibility will diminish, potentially affecting its primary use case as electronic currency.

The concerns are valid: the original Bitcoin whitepaper does not account for unique digital assets, extra data contributing to blockchain bloat, nor inscriptions that could reduce fungibility. Still, ordinals are, in fact, a byproduct of utilizing the Bitcoin blockchain as it exists today and the subsequent crypto innovations that have come since, even if not initially envisioned by Bitcoin’s creator. And—while the inscription of satoshis does decrease fungibility—it is estimated that it would take around 238 years7 to mint ~.24% of total terminal BTC supply.

灰度:SEC一再拒绝现货比特币ETF可能违反行政程序法:金色财经报道,在美国证券交易委员会(SEC)最近拒绝了比特币交易所交易基金(ETF)之后,灰度正在反驳该监管机构的论点。灰度致函SEC,声称该机构愿意批准基于期货的产品而非现货产品是“任意和反复无常的”,称SEC的一再拒绝可能违反《行政程序法》(APA)。据悉,APA管理联邦机构的决策过程。灰度在信中说:“根据1940年法案注册的比特币期货ETP和不需要或没有资格注册的现货比特币ETP在所有相关方面都是相同的,但根据2021年11月12日的不批准命令中的分析,SEC对它们的的处理不一样”。[2021/12/1 12:42:42]

We believe that ordinals are positive for the Bitcoin network in two key ways: resulting in an increase of Bitcoin miner fees, and potentially contributing to a cultural transformation within the Bitcoin community.

One of the largest open issues related to Bitcoin’s economic model is the security budget, which is the concern that once all new tokens have been mined, miner rewards derived from transaction activity may eventually prove insufficient to motivate miners to maintain an adequate hash rate for securing the network. The advent of ordinals has led to an increase in total fees paid to miners (Figure 5), which could potentially establish a sustainable baseline level of transaction fees to incentivize miners, thereby ensuring continued network security throughout the lifetime of the Bitcoin network.

Figure 5: Bitcoin Total Fees

Source: Glassnode, as of 4/21/2023. For illustrative purposes only.

声音 | 灰度:加密货币信托基金在2019全年募集量超过前6年总和:美国加密货币投资机构Grayscale发布 2019 全年投资报告,数据显示 2019 年 Grayscale 共募集超过 6 亿美元,这个数字超过了Grayscale 产品在 2013 年到 2018 年的累计募集总额。自成立以来,Grayscale 系列产品的累计投资额达到了 11.7 亿美元。比特币信托基金的单季度最大投资额为 2019 年第四季度,共计 1.9 亿美元。Grayscale 的用户规模也在 2019 年增长了约 24%,约占新投资额的 24%。有 36% 的客户投资了多款 Grayscale 旗下的产品。[2020/1/17]

Bitcoin-the largest digital asset by market cap and mainstream awareness-has been criticized by some crypto insiders and developers as a relatively stagnant community and blockchain. Based on the velocity of NFT adoption witnessed on other chains, such as Ethereum, we believe that ordinals have the potential to attract new users who may not have previously considered using Bitcoin. We believe the emergence of ordinals is likely to promote a development-oriented community and culture in support of the Bitcoin network.

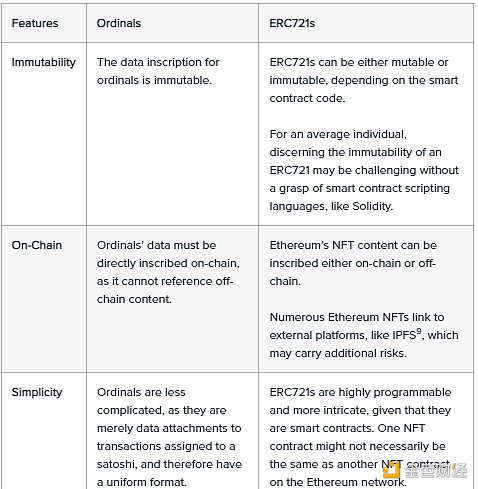

Since its inception in 2017, the ERC721 standard has been adopted by some of the most well-known NFT collections on Ethereum. While other blockchains use their own standards, it is a natural reference point to compare Bitcoin Ordinals to Ethereum’s ERC721, considering Ethereum NFTs account for nearly 90% of the total NFT market share. Ordinals exhibit several notable distinctions in comparison.

Ultimately, ordinals present a straightforward manifestation of non-fungible digital assets due to their immutable nature, absence of programmability, and mandatory on-chain inscription requirements, as opposed to ERC721s. Although Ethereum NFTs boast greater programmability and currently dominate the NFT market in terms of volume and popularity, ordinals could be an appealing alternative for those seeking a straightforward, scarcer digital asset on the most established blockchain available.

Although ordinals are a recent development, they have already amassed over one million inscriptions within a mere four months, even during a bear market. This unexpected surge in popularity may indicate a shift in the broader perception of Bitcoin, despite its reputation as an ossified blockchain. While legitimate concerns exist, we believe that ordinals have the potential to positively impact the Bitcoin network in the longer-term, attracting a new wave of enthusiastic users and developers to embrace the Bitcoin community.

“Ordinals” refers to a numbering scheme for satoshis that allows tracking and transferring individual satoshis.

A non-fungible token is a unique digital identifier that is recorded on a blockchain, and is used to certify ownership and authenticity.

Fungibility is the property of a good or a commodity whose individual units are essentially interchangeable, and each of whose parts are indistinguishable from any other part.

The smallest unit of bitcoin; there are 100 million satoshis in one bitcoin.

Layer 2 blockchain solutions are protocols designed to function atop a Layer 1 blockchain (such as Bitcoin or Ethereum) with the aim of enhancing scalability, privacy, and other attributes of the foundational blockchain.

The witness segment within a Bitcoin transaction is responsible for housing transaction signatures. This information can be converted into accessible content-qjnu for any Bitcoin node utilizing the ORD software.

500 million inscriptions assuming around 10,000 satoshis per inscription, which equates to approximately 50,000 BTC inscribed or 0.24% of the total terminal supply of 21 million.

Ethereum Request for Comments (ERC) 721 is a data standard for creating non fungible tokens, meaning each token is unique and cannot be divided or directly exchanged for another ERC-721 token. The ERC-721 standard allows creators to issue unique crypto assets like NFTs via smart contracts.

The InterPlanetary File System is a protocol, hypermedia and file sharing peer-to-peer network for storing and sharing data in a distributed file system.

来源:鸵鸟区块链

鸵鸟创投媒体

媒体专栏

阅读更多

金色荐读

金色财经 善欧巴

Chainlink预言机

区块律动BlockBeats

白话区块链

金色早8点

Odaily星球日报

欧科云链

MarsBit

深潮TechFlow

标签:ORDANDDINAALSord币今日价格Meta DecentralandDinamo Zagreb Fan TokenALSC

DeFi数据 1、DeFi代币总市值:464.01亿美元 DeFi总市值及前十代币 数据来源:coingecko2、过去24小时去中心化交易所的交易量15.

Memecoin (模因币)热潮正在蔓延!一种称为 BRC-20 的新代币类型吸引了开发人员,并在比特币区块链上提供了类似于以太坊生态中的垃圾币的体验.

▌Bancor协议创始人被指控误导投资者进行虚假的无风险投资Bancor Protocol创始人以及BProtocol Foundation和Bancor DAO已经被提起集体诉讼.

头条 ▌BRC-20代币总市值接近4亿美元数据显示,比特币铭文代币Ordi现报12.48美元,24小时涨幅30.54%,当前总市值已达2.62亿美元.

近期有一部分 NFT 投资者和大户因为一些状况或 NFT 市场变化而退圈,随之而来的是一些人对 NFT 的「唱衰」,NFT 资深玩家 wale.swoosh 发文解释了 NFT 的现状.

作者:limblock 来源:作者同名公众号前两天,胖老师写了一篇分析以太坊手续贵原因的文章。后来,有老哥留言表示,坎昆升级会让以太坊layer2手续费更低,交易体验更好.